2025 Self Employed 401k Contribution Limits. This amount is up modestly from 2025, when the individual 401. The 401 (k) contribution limit for 2025 is $23,000.

401 (k) contribution limits in 2025 and 2025. For 2025, the solo 401 (k) contribution limits are $66,000 or $73,500 if you are at least age 50.

How Much Can I Contribute To My SelfEmployed 401k Plan?, What are the 2025 solo 401k contribution limits? In 2025, you can contribute $23,000 to the roth portion of your solo 401 (k).

401k Limits In 2025 Elana Virginia, 401 (k) contribution limits in 2025 and 2025. You can contribute to more than one 401 (k) plan.

401k 2025 Limit Over 50 Aggie Sonnie, What are the new solo 401k contribution limits for 2025? For traditional and roth ira plans, the.

2025 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, The basic limit on elective deferrals is $23,000 in 2025, $22,500 in 2025, $20,500 in 2025, $19,500 in 2025 and 2025, and $19,000 in 2019, or 100% of the. Exceeding the hsa contribution limit comes with financial penalties.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, For 2025, the max is $69,000 and $76,500 if you are 50 years old or older. In 2025, you can contribute $23,000 to the roth portion of your solo 401 (k).

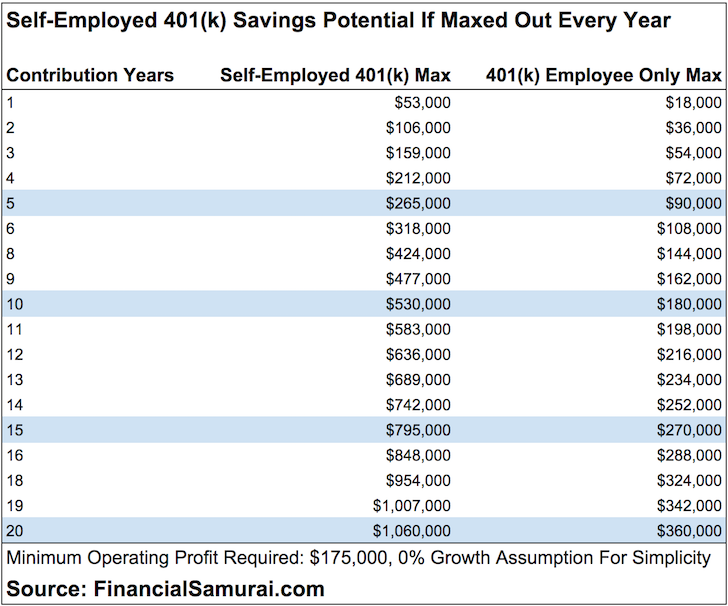

The Maximum 401k Contribution Limit Financial Samurai, For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. When it comes to individual 401(k) contribution limits, it helps to separate the limits that apply to you as an employee and yourself as the employer.

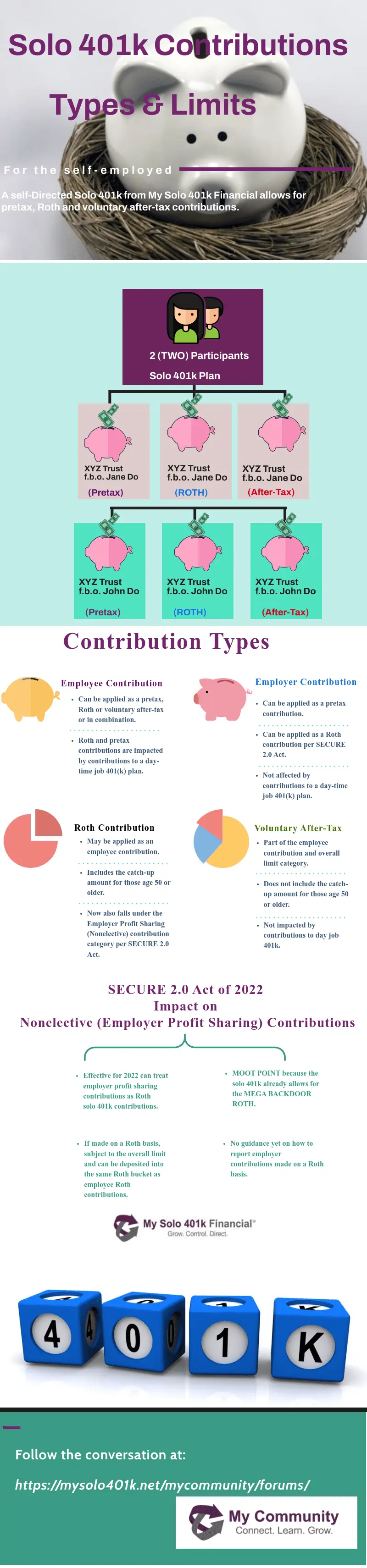

solo 401k contribution limits and types, These were announced by the irs on november 1, 2025. This amount is an increase of.

SelfEmployed 401k Plan Advantage IRA Financial Group, Fidelity self employed 401k contribution form: For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 401 (k) 2025 limit of $22,500.

How Much Can I Contribute To My SelfEmployed 401(k) Plan?, When it comes to individual 401(k) contribution limits, it helps to separate the limits that apply to you as an employee and yourself as the employer. For 2025, there’s a slight increase in the amount you can save in your 401 (k) plan.

SelfEmployed 401k Contribution Worksheet Free Download, What are the 2025 solo 401k contribution limits? For 2025, the solo 401 (k) contribution limits are $66,000 or $73,500 if you are at least age 50.